The SMR Market Correction: Why the AI Infrastructure Timeline Requires a Gas-to-Nuclear Bridge

- Tony Grayson

- Nov 28, 2025

- 8 min read

Updated: Dec 22, 2025

By Tony Grayson Tech Executive (ex-SVP Oracle, AWS, Meta) & Former Nuclear Submarine Commander

Published: November 28, 2025 | Last Updated: December 22, 2025

TL;DR — Key Takeaways

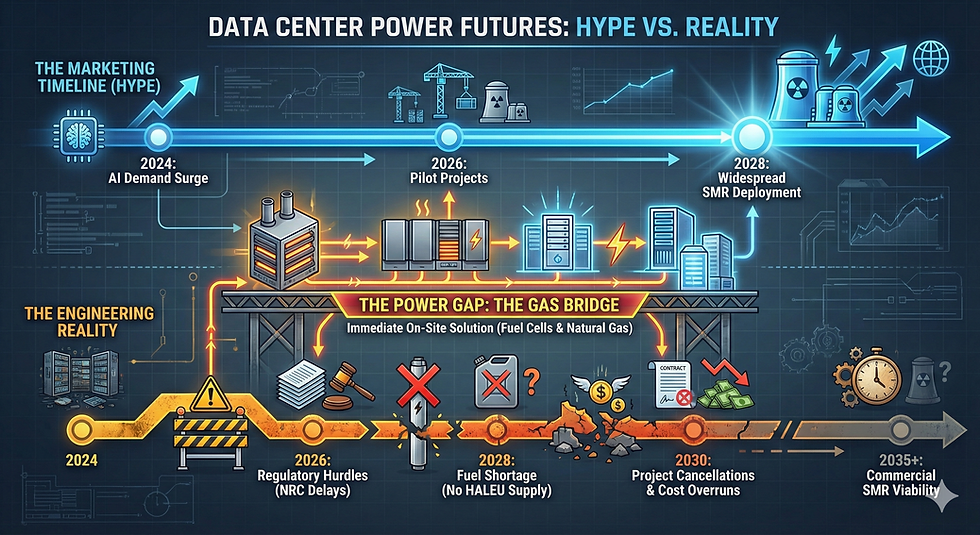

SMR 2027 was a valuation bubble, not a timeline. NuScale down 30% from peak. NRC licensing takes 5-7 years minimum. Realistic SMR deployment is 2032+.

The real stranded asset risk is dark GPUs. $500M of compute depreciating while waiting for power that never comes. Every quarter idle, your IRR evaporates.

Design for the Swap. 10-15% CapEx premium buys nuclear-rated switchgear, seismic pads, and parallel NRC licensing—a call option on a $5 trillion market transition.

Gas is the bridge, not the villain. On-site generation provides immediate revenue and "additionality"—leaving cleaner electrons on the grid for residential use.

The SMR index is down 30% from its March peak. NuScale's latest correction confirms what energy infrastructure veterans knew: the "Nuclear Renaissance" is real, but "SMR commercialization by 2027" was a valuation bubble, not a deployment timeline. The financial fallout, detailed in reports on NuScale's latest correction, is forcing a productive shakeout.

This market correction flushes out momentum traders and leaves serious capital to solve the actual constraint: a timeline mismatch that threatens the ROI of a $5 trillion AI infrastructure buildout. The problem isn't nuclear technology—the problem is math.

(For more on why the SMR timeline doesn't match the marketing, see my previous analysis: Nuclear Power for AI Data Centers: Why SMR Reality Doesn't Match the Marketing Timeline)

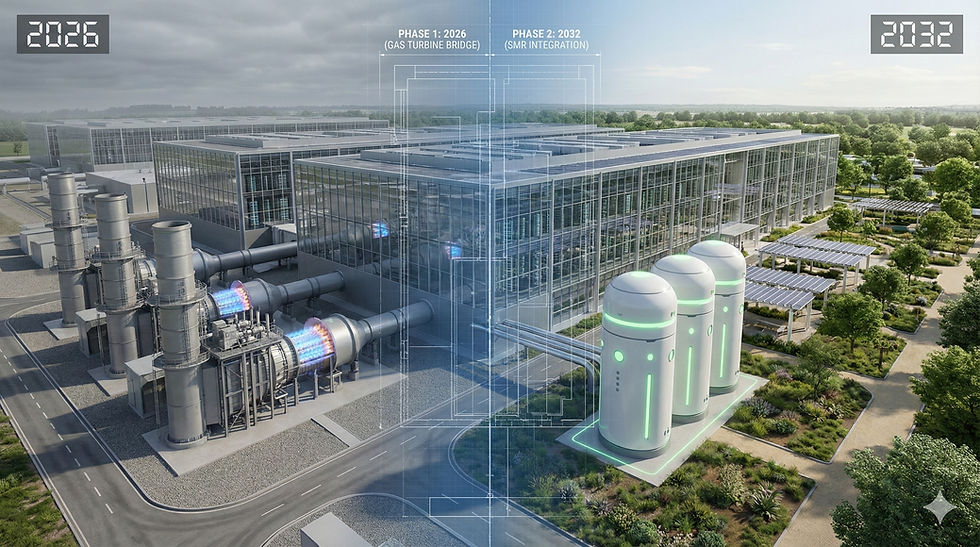

The AI Infrastructure SMR Bridge: Solving the Timeline Gap

The core conflict in today's energy market is simple: AI speed versus regulatory speed.

Timeline Component | Duration | Constraint |

AI Hardware Refresh | 18–24 Months | Business imperative for competitive compute. |

Grid Interconnection | 5–7 Years | Median regulatory bottleneck confirmed by Lawrence Berkeley National Lab data. |

Realistic SMR Deployment | 2032+ | Proven regulatory and manufacturing timeline. |

If you are a CFO relying on an SMR to power your 2026 data center deployment, you're not managing risk—you’re guaranteeing zero revenue on capital that is already depreciating. This is the Stranded Asset Risk: $500M of compute sitting dark because you bet on a timeline that slipped. Every quarter those GPUs sit idle, your negative carry compounds, and your IRR evaporates. This risk is just as critical as the hardware financial risks I've explored previously, such as Nvidia Vendor Financing and Infrastructure Risks.

The AI Infrastructure SMR Bridge strategy solves this by mandating that we generate revenue immediately with reliable power, while designing the infrastructure to transition seamlessly to nuclear later.

"Design for the Swap" Engineering

This is not marketing language; it’s an engineering specification for a nuclear-ready future:

Electrical Infrastructure: Install medium-voltage switchgear rated for nuclear load profiles from day one. This 10–15% CapEx premium acts as a call option on future nuclear, bought at today's construction prices.

Civil & Seismic: Pour seismic isolation pads for future reactor modules during initial site development. Delaying this guarantees costly remobilization and operational disruption.

Regulatory Parallel Path: Initiate NRC site characterization and Emergency Planning Zone (EPZ) studies alongside your gas turbine air permit. Running the "Paper Reactor" licensing in parallel compresses the SMR transition by 2–3 years.

Repositioning Natural Gas for Sustainability

The on-site gas generation required for the AI Infrastructure SMR Bridge can be reframed for ESG:

Accurate Framing (Additionality): On-site gas generation provides additionality. You are leaving cleaner electrons on the grid for residential use, preventing the hyperscaler from cannibalizing existing green power and stabilizing the grid system-wide.

Efficient gas that stabilizes the grid becomes part of the decarbonization solution, not the villain.

The Capital Efficiency of the Nuclear Bridge Strategy

For investment committees evaluating power options for AI Infrastructure:

Scenario | Timeline to Revenue | CapEx Premium for Swap | Optionality Preserved |

Wait for SMR | 2032+ | 0% | None |

Nuclear Bridge | 18–24 months (gas operational) | 10–15% | Full SMR integration path preserved |

The 10–15% premium is the cost of buying an option on a $5T market transition, ensuring revenue starts flowing immediately.

Frequently Asked Questions (FAQ)

Who is Tony Grayson?

Tony Grayson is President & General Manager of Northstar Enterprise + Defense, former Commanding Officer of USS Providence (SSN-719), and recipient of the Vice Admiral James Bond Stockdale Award. He serves on advisory boards for TerraPower and Holtec International.

What qualifies Tony Grayson to write about SMRs and nuclear power?

Tony holds DOE/Naval Reactors nuclear operator certification from 21 years operating nuclear submarines. He serves on advisory boards for TerraPower and Holtec International, and led $1.3B infrastructure strategy at Oracle including power procurement for global data center operations.

What is the SMR Market Correction and why is it happening?

The SMR (Small Modular Reactor) Market Correction is the recent financial drop (e.g., NuScale down 30% from its peak) resulting from the conflict between aggressive commercial valuation and the proven realities of regulatory deployment timelines. NRC licensing takes 5-7 years minimum, and manufacturing supply chains are still maturing. SMR commercialization by 2027 was a valuation bubble, not a deployment timeline—the correction flushes out momentum traders and leaves serious capital to solve the actual timeline constraints.

What is the key conflict in the AI Infrastructure SMR Bridge Strategy?

The key conflict is the timeline mismatch: AI hardware refreshes every 18-24 months, while grid interconnection takes 5-7 years (per Lawrence Berkeley National Lab data) and realistic SMR deployment won't happen until 2032 or later. The AI Infrastructure SMR Bridge strategy solves this by generating revenue immediately with gas generation while designing infrastructure to transition seamlessly to nuclear later. For more detail, see Nuclear Power for AI Data Centers: Why SMR Reality Doesn't Match the Marketing Timeline.

What is Stranded Asset Risk in AI infrastructure?

The true Stranded Asset Risk is not that a gas plant will become obsolete—it's that $500 million of purchased GPU compute will sit dark and depreciate because it has no reliable power source, having bet on an SMR or grid timeline that slipped. Every quarter those GPUs sit idle, your negative carry compounds and your IRR evaporates. The risk is compute depreciation, not generation asset obsolescence. This risk parallels the financial risks explored in Nvidia Vendor Financing and Infrastructure Risks.

What does "Design for the Swap" mean?

Design for the Swap is an engineering strategy to build a power-agnostic data center today that can seamlessly transition to nuclear later. It includes: (1) Installing medium-voltage switchgear rated for nuclear load profiles from day one (10-15% CapEx premium as a call option on future nuclear); (2) Pouring seismic isolation pads for future reactor modules during initial site development; (3) Running NRC site characterization and Emergency Planning Zone studies in parallel with gas turbine air permits to compress SMR transition by 2-3 years.

When will SMRs be ready to power data centers?

Realistic SMR deployment for data centers is 2032 or later. NuScale remains the only SMR with NRC design approval (77 MWe US460 approved May 2025), but construction permits still take 30+ months after design approval. TerraPower's Natrium target slipped from 2028 to 2031 due to HALEU fuel shortages. Most analysts expect first commercial SMRs for data centers in the early-to-mid 2030s. The gas-to-nuclear bridge generates revenue immediately while preserving optionality for nuclear integration.

Why are Amazon, Microsoft, and Google investing in nuclear power?

Hyperscalers are investing in nuclear because AI workloads demand 24/7 baseload power that renewables alone cannot provide. Google's carbon emissions rose 48% since 2019; Microsoft's rose 30% since 2020—largely from data center construction. Microsoft signed a 20-year PPA with Constellation to restart Three Mile Island Unit 1; Amazon committed to 5 GW of SMR capacity with X-energy; Google partnered with Kairos Power for 500 MW by 2035. However, smart operators are using gas-to-nuclear bridge strategies. See DOE's analysis of nuclear-powered data centers.

What is HALEU fuel and why does it matter for SMRs?

HALEU (High-Assay Low-Enriched Uranium) is uranium enriched to 5-20% U-235 concentration, required for most advanced reactor designs including TerraPower Natrium and X-energy Xe-100. The problem: before the Ukraine invasion, Russia was the only commercial source. Current U.S. production capacity is minimal (Centrus delivered first 20 kg in late 2024), but DOE projects demand of 40+ metric tons by 2030. DOE has awarded up to $2.7 billion in contracts to establish domestic HALEU supply. NuScale's design uses conventional low-enriched uranium, avoiding the HALEU constraint.

What is the NuScale US460 design approval?

In May 2025, NRC approved NuScale's US460 Standard Design Approval—their uprated 77 MWe (462 MW total for six-module plant) SMR design. It's the only SMR with NRC design approval in the U.S. The review was completed in under two years, ahead of schedule. However, design approval doesn't authorize construction—developers must still apply for construction permits (30+ months) or combined licenses. NuScale targets deployment by 2030, with ENTRA1 Energy and TVA announcing a landmark 6 GW deployment program in September 2025.

How does grid interconnection delay AI infrastructure?

Grid interconnection is the median regulatory bottleneck: Lawrence Berkeley National Lab data shows 5-7 years from application to energization. Data centers requiring 100+ MW can't wait that long when AI hardware refreshes every 18-24 months. On-site generation (gas or nuclear) bypasses grid queue constraints, which is why companies are building power plants inside their fence line or adjacent to data centers rather than waiting for transmission interconnection.

What is the 10-15% CapEx premium for nuclear-ready design?

The 10-15% CapEx premium covers nuclear-rated electrical infrastructure (medium-voltage switchgear rated for nuclear load profiles), seismic isolation pads for future reactor modules, and parallel regulatory work (NRC site characterization, Emergency Planning Zone studies). This premium is the cost of buying an option on a $5 trillion market transition—it ensures revenue starts flowing immediately with gas while preserving the full SMR integration path without costly remobilization or operational disruption.

How does on-site gas generation support ESG goals?

On-site gas generation provides "additionality"—you leave cleaner electrons on the grid for residential use rather than the hyperscaler cannibalizing existing green power. This stabilizes the grid system-wide. Efficient gas that stabilizes the grid becomes part of the decarbonization solution, not the villain. The gas-to-nuclear bridge strategy positions gas as a transitional bridge fuel while the infrastructure is pre-engineered for eventual SMR swap-in.

What is the TVA-ENTRA1 6 GW SMR program?

In September 2025, ENTRA1 Energy and Tennessee Valley Authority announced the largest SMR deployment program in U.S. history, up to 6 gigawatts of NuScale SMR capacity across TVA's seven-state service region. The program aims to deploy six ENTRA1 Energy Plants powered by NuScale Power Modules to provide 24/7 baseload power for hyperscale data centers, AI, and semiconductor manufacturing. This represents serious capital commitment to SMR deployment, targeting the 2030s timeline rather than the previously hyped 2027 commercialization.

Tony Grayson

___________________________________

Tony Grayson is a recognized Top 10 Data Center Influencer, a successful entrepreneur, and the President & General Manager of Northstar Enterprise + Defense.

A former U.S. Navy Submarine Commander and recipient of the prestigious VADM Stockdale Award, Tony is a leading authority on the convergence of nuclear energy, AI infrastructure, and national defense. His career is defined by building at scale: he led global infrastructure strategy as a Senior Vice President for AWS, Meta, and Oracle before founding and selling a top-10 modular data center company.

Today, he leads strategy and execution for critical defense programs and AI infrastructure, building AI factories and cloud regions that survive contact with reality.

Read more at: tonygraysonvet.com

What do you think?