From Parameters to Physics: Why Watts per Token is the Only Metric for Industrial AI

- Tony Grayson

- Dec 5

- 10 min read

Updated: 4 days ago

By Tony Grayson, Tech Executive (ex-SVP Oracle, AWS, Meta) & Former Nuclear Submarine Commander

On a recent trip to Silicon Valley, one thing became abundantly clear: The "Software Era" of AI is over. The "Industrial Infrastructure Era" has begun.

As we make this transition, the metric for success is changing. We are moving from a world of infinite parameters to a world of finite physics. The new metric isn't "Parameters per Model"—it’s "Watts per Token."

This shift explains everything happening in the market right now: why Satya Nadella is hedging his capital, why Amazon is warning of a "Compute Reckoning," and why the nuclear timeline is disconnected from reality. Here is the hard truth about the landscape as we head into 2026.

The Satya Hedge: Neoclouds as a Capital Buffer

The Short Answer: Microsoft is hedging its massive AI infrastructure bet by leasing compute from neoclouds (like CoreWeave) instead of buying it all. This effectively treats neoclouds as a "Bad Bank" for hardware risk—forcing them to hold the high-interest debt and the depreciating H100s, while Microsoft protects its own balance sheet.

Microsoft is making headlines for securing capacity through neocloud partners like CoreWeave, Lambda, and Nebius. This is a deliberate hedge. Microsoft builds what it knows it needs; it leases what it might need. The neoclouds absorb the CapEx uncertainty.

The "Winner's Curse" and Inventory Risk

In his own words, CEO Satya Nadella explicitly warned of a "Winner’s Curse" for companies building frontier models, noting they are “one copy away from being commoditized”.

His stated constraint isn't silicon; it's the physical buildings: "It's actually the fact that I don't have warm shells to plug into... that is my problem today."

The "Bad Bank" Reality: By signing leases with neoclouds, Microsoft solves this "inventory problem" without taking on the toxic risk profile. The neoclouds take on billions in debt (CoreWeave now carries nearly $14.6 billion in debt and equity financing). Worse, Microsoft accounts for roughly 62% of CoreWeave's revenue, concentrating risk for its biggest partner. This is a classic example of financial engineering masking physical infrastructure constraints.

The Compute Reckoning: Why Amazon Prioritizes Energy Efficiency

The Short Answer: Amazon CTO Werner Vogels predicts a “Great Compute Reckoning”, warning that the era of energy-hungry, general-purpose compute is ending. AI success will now depend on specialized, energy-efficient silicon, reinforcing the criticality of the "Watts per Token" metric.

While Satya talks about financial hedging, Amazon CTO Werner Vogels is sounding the alarm on the physics of AI scaling. Vogels argues that the "Software Era" of throw-it-at-the-wall experimentation is over. We are entering a phase of "Industrial AI", defined by rigid energy constraints and cost-per-inference.

"The era of the 'one-size-fits-all' approach to silicon is ending... The future of AI scalability relies on decoupling compute growth from carbon growth." — Werner Vogels

Both titans are telling you the same thing: The current method of scaling AI data centers is financially and physically unsustainable. Success will be defined by the least amount of power required to generate a useful output (Watts per Token).

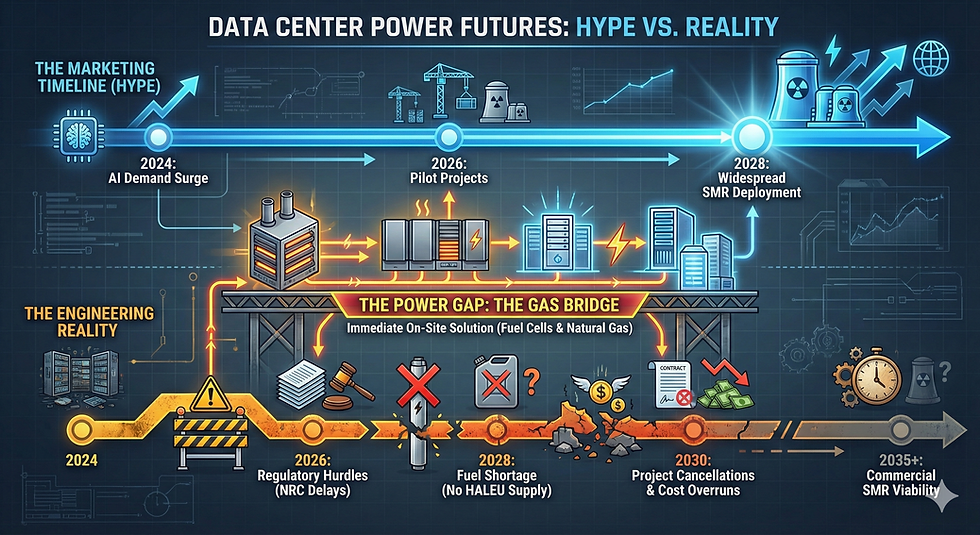

The SMR Reality Check: A 2030+ Solution for a 2026 Problem

The Short Answer: The Small Modular Reactor (SMR) industry is facing a systemic timeline gap. SMRs will not be ready to power the current wave of AI data centers due to cost and supply chain issues, pushing their commercial viability to 2030 or beyond.

The market is conflating Government Pilot Projects with Commercial Grid Assets. While I commanded a nuclear submarine and champion the technology, we must be honest about the timeline.

The SMR Scorecard

NuScale (The Economics): NuScale, the only company with an NRC-certified design, saw its flagship Utah project shelved because costs exploded to $89/MWh, leading utilities to walk away.

TerraPower (The Fuel Delay): Bill Gates’ company is ready to build, but they have no fuel. The Natrium design requires HALEU (High-Assay Low-Enriched Uranium). With the primary supplier (Russia) being unavailable, they have already delayed their launch to 2030 or beyond.

The Verdict: If a hyperscaler needs 100MW+ today to burn through chip inventory, SMRs are a distraction. You cannot get the "Watts per Token" you need from a reactor that doesn't exist.

The Gas Bridge: The Only Viable Solution for Speed

We are entering a phase of brutal realism: Nuclear is too slow (2030+), and the legacy electric Grid is too congested (5+ year queues).

The only solution that scales immediately is the Gas Bridge.

This isn't theory; it’s happening now. Bloom Energy’s recent $5 billion deal with Brookfield proves the smart money is moving to on-site fuel cells to bypass the grid entirely.

The strategic imperative is clear: stop waiting for the grid. Deploy modular, high-density units that can run on natural gas today and seamlessly transition to hydrogen tomorrow.

At Northstar Enterprise + Defense, we build the modular infrastructure that enables this bridge. We deploy the high-density "warm shells" (up to 150kW per rack) that integrate directly with on-site power, solving the speed, power, and efficiency problem all at once. We are the answer to Satya's inventory problem, measured by the only metric that matters: Watts per Token.

Frequently Asked Questions: Watts per Token & The AI Energy Crisis

What does "Watts per Token" mean for AI infrastructure?

Watts per Token is the new key performance indicator (KPI) for the industrial AI era. It measures the amount of electrical power (Watts) required to generate one unit of meaningful AI output (Token). As power and cooling costs dominate data center CapEx, efficiency (lower Watts per Token) becomes the most critical factor for profitability and scalability. According to Amazon CTO Werner Vogels, the metric signals a shift from the "Software Era" of AI—focused on parameters and model size—to the "Industrial Infrastructure Era" defined by physics and energy constraints.

Why is Microsoft using a "leasing strategy" for AI hardware?

Microsoft's leasing strategy (using neoclouds like CoreWeave, Nebius, and Lambda) is a financial hedge against the Winner's Curse. By signing long-term leases totaling over $33 billion, Microsoft mitigates the risk of owning billions of dollars in specialized hardware (like H100s) that could rapidly depreciate if the market for frontier AI models crashes or new, more efficient chips emerge. Satya Nadella explicitly warned that frontier models are "one copy away from being commoditized." The neoclouds absorb the CapEx uncertainty while Microsoft keeps debt and hardware depreciation off its balance sheet.

What is the "Great Compute Reckoning"?

The "Great Compute Reckoning" is Amazon CTO Werner Vogels' prediction that the industry must abandon the energy-intensive, general-purpose approach to AI. It signals the end of simple brute-force scaling and the start of an era defined by energy constraints. Vogels argues that "the era of the one-size-fits-all approach to silicon is ending" and that "the future of AI scalability relies on decoupling compute growth from carbon growth." Success will now hinge on specialized, energy-efficient silicon that lowers the Watts per Token.

Why can't SMRs solve the data center power crisis today?

Commercial SMRs (Small Modular Reactors) face a significant timeline gap, making them a 2030+ solution for a 2026 problem. Key setbacks include the cancellation of NuScale's flagship Utah project due to costs that rose to $89/MWh, prompting utilities to walk away. TerraPower is ready to build but has no fuel—the Natrium design requires HALEU (High-Assay Low-Enriched Uranium), and with the primary supplier (Russia) unavailable, they've delayed launch to 2030 or beyond. SMRs are not commercially ready to supply the immediate, large-scale AI data center power demands hyperscalers need now.

What is the "Gas Bridge" strategy for data centers?

The Gas Bridge is the strategy of using on-site natural gas and fuel cells (like Bloom Energy) to power data centers immediately, bridging the 10-year gap until nuclear SMRs and grid upgrades become available. Nuclear is too slow (2030+) and the legacy electric grid is too congested (5+ year interconnection queues). The Gas Bridge isn't theory—it's happening now. Bloom Energy's $5 billion deal with Brookfield proves smart money is moving to on-site fuel cells to bypass the grid entirely.

What is a neocloud and why are they important?

A neocloud is an "AI hyperscaler" without the legacy baggage of general-purpose clouds, singularly focused on serving the exploding needs of AI model training and inference. Companies like CoreWeave, Nebius, Lambda, and Nscale specialize in leasing GPU clusters to AI developers. According to JLL data, the neocloud sector has grown at a five-year compound annual rate of 82% since 2021. They're important because traditional hyperscalers can't match their GPU density, speed of deployment, or pricing—renting an NVIDIA A100 on CoreWeave costs approximately $1.39/hour versus $3.67/hour on Azure, a 62% cost advantage.

How much electricity do AI data centers consume?

According to the International Energy Agency (IEA), global data centers consumed around 415 TWh of electricity in 2024 (about 1.5% of global demand). Consumption is projected to more than double by 2030 to around 945 TWh—equivalent to Japan's entire electricity consumption. AI is the primary driver of this growth. In the United States, data centers consumed 183 TWh in 2024 (over 4% of total consumption). By 2030, this could grow by 133% to 426 TWh.

Why is Microsoft paying CoreWeave when it builds its own data centers?

Microsoft's constraint isn't silicon, it's physical buildings. Satya Nadella stated: "It's actually the fact that I don't have warm shells to plug into... that is my problem today." Microsoft builds what it knows it needs; it leases what it might need. This is a "Bad Bank" strategy—neoclouds take on billions in debt (CoreWeave carries nearly $14.6 billion in debt and equity financing) and hold the depreciating H100s. According to SemiAnalysis, Microsoft accounts for roughly 62% of CoreWeave's revenue, concentrating risk for its partner while protecting its own margins.

What is HALEU fuel and why is it delaying nuclear power for data centers?

HALEU (High-Assay Low-Enriched Uranium) is a specialized nuclear fuel required by advanced reactor designs like TerraPower's Natrium. It contains uranium enriched to between 5% and 20% U-235, higher than conventional reactor fuel but below weapons-grade. The problem: Russia was the primary supplier, and with that source unavailable due to geopolitics, there is no domestic HALEU supply chain. This fuel shortage has delayed TerraPower's reactor launch to 2030 or beyond, making advanced nuclear a distant solution for today's AI power demands.

How are AI data centers affecting electricity prices?

AI data centers are driving significant increases in electricity prices, particularly in regions near data center hotspots. Bloomberg analysis shows wholesale electricity costs are up to 267% higher than five years ago in areas near data centers. In the PJM electricity market (Illinois to North Carolina), data centers accounted for an estimated $9.3 billion price increase in capacity markets. Average residential bills are expected to rise $18/month in western Maryland and $16/month in Ohio. Carnegie Mellon estimates that data centers could increase average U.S. electricity bills by 8% by 2030, potentially exceeding 25% in northern Virginia.

What is the "Winner's Curse" in AI that Satya Nadella warned about?

The "Winner's Curse" is Satya Nadella's warning that companies building frontier AI models are "one copy away from being commoditized." Once a model is trained, it can be replicated and distributed at near-zero marginal cost, meaning the billions invested in training infrastructure may never generate proportional returns. This explains Microsoft's hedging strategy—rather than owning all the hardware that could become worthless if a competitor's model commoditizes the market, Microsoft leases capacity from neoclouds. If demand crashes, Microsoft can walk away from leases more easily than it can sell depreciated data centers.

What does the shift from "Parameters to Physics" mean for AI companies?

The shift from "Parameters to Physics" means the AI industry is transitioning from the "Software Era"—where success was measured by model size and parameter count—to the "Industrial Infrastructure Era" where success is measured by energy efficiency (Watts per Token). The current method of scaling AI data centers is financially and physically unsustainable. Both Microsoft (through financial hedging) and Amazon (through Werner Vogels' Compute Reckoning warning) are signaling the same truth: success will be defined by the least amount of power required to generate useful AI output, not by who has the biggest model.

At Northstar Enterprise + Defense, we build the modular infrastructure that enables this bridge. We deploy the high-density "warm shells" (up to 150kW per rack) that integrate directly with on-site power, solving the speed, power, and efficiency problem all at once.

We are the answer to Satya's inventory problem.

Frequently Asked Questions (FAQ)

Why is Microsoft leasing data centers from CoreWeave? Microsoft uses a 'leasing strategy' to mitigate financial risk. By renting compute from neoclouds like CoreWeave (in a deal worth $10 billion), they keep the debt and hardware depreciation off their own balance sheet. This protects Microsoft's margins if the H100 chip market value crashes.

What is Werner Vogels' prediction for AI infrastructure? Amazon CTO Werner Vogels predicts a "Great Compute Reckoning" where the industry must shift from general-purpose GPUs to specialized, energy-efficient silicon. He argues that "one-size-fits-all" computing is unsustainable and that future AI success will depend on decoupling compute growth from energy consumption.

When will SMRs be ready for data centers? Commercial SMRs are unlikely to power data centers before 2030-2035. Major setbacks include NuScale cancelling its Utah project due to costs rising to $89/MWh, Oklo's initial NRC license denial in 2022, and TerraPower delaying its Natrium reactor to 2030 due to HALEU fuel shortages.

What is the "Gas Bridge" for data centers? The "Gas Bridge" is the strategy of using on-site natural gas and fuel cells (like Bloom Energy) to power data centers immediately, bridging the 10-year gap until nuclear SMRs and grid upgrades become available.

____________________________________

Tony Grayson is a recognized Top 10 Data Center Influencer, a successful entrepreneur, and the President & General Manager of Northstar Enterprise + Defense.

A former U.S. Navy Submarine Commander and recipient of the prestigious VADM Stockdale Award, Tony is a leading authority on the convergence of nuclear energy, AI infrastructure, and national defense. His career is defined by building at scale: he led global infrastructure strategy as a Senior Vice President for AWS, Meta, and Oracle before founding and selling a top-10 modular data center company.

Today, he leads strategy and execution for critical defense programs and AI infrastructure, building AI factories and cloud regions that survive contact with reality.

Comments