AI Infrastructure Financing Risks: What JLL's 2026 Data Center Outlook Missed

- Tony Grayson

- Jan 12

- 19 min read

A Nuclear Submarine Commander's Analysis of the $3 Trillion "Supercycle."

By Tony Grayson, President & GM of Northstar Enterprise + Defense | Former U.S. Navy Nuclear Submarine Commander | Stockdale Award Recipient | Veterans Chair, Infrastructure Masons

Published: January 11, 2026

TL;DR

JLL's 2026 Global Data Center Outlook projects a $3 trillion "supercycle" and declares fundamentals healthy. But the AI infrastructure financing risks are significant: $870B in new debt backed by assets with 3-year useful lives, circular vendor financing masquerading as demand, no secondary market for GPU collateral, and only 0.26% of investment covered by sovereign demand. The hyperscalers will survive. The capital stacked behind neoclouds, merchant operators, and GPU-backed lending is where the fragility lives. I'm bullish on AI technology. I'm bearish on the financing behavior around it.

"I'm bullish on the technology. I'm bearish on the behavior." — Tony Grayson

30-Second Summary

The Report: JLL projects 100GW of new data center capacity by 2030, requiring $3 trillion in investment and $870 billion in new debt

The Claim: "Property metrics do not point to a bubble."

The Problem: Two-thirds of CapEx is hardware with a 3-year shelf life, financed like 20-year real estate

The AI Infrastructure Financing Risks: No secondary market for GPU collateral, circular vendor financing, hyperscaler overbuild crushing everyone else

The Pattern: Same normalcy bias that preceded the Challenger disaster and the 1970s nuclear overbuild.

The Bottom Line: The technology is revolutionary. Some of the financing is reckless.

Commander's Intent

Purpose: Equip investors, operators, and allocators with a clear-eyed assessment of AI infrastructure financing risks that JLL's report obscures.

End State: Readers understand the distinction between hyperscaler-backed debt (probably safe) and merchant GPU leverage (fragile), can identify circular vendor financing patterns, and recognize the asset-liability mismatch at the heart of this "supercycle."

Key Tasks:

Acknowledge the strongest counter-arguments to this thesis

Identify the five critical gaps in JLL's analysis

Connect current patterns to historical precedents (Challenger, 1970s nuclear overbuild)

Provide specific questions capital allocators should be asking

Background: Understanding AI Infrastructure Financing

Before diving into the analysis, here's a quick primer on the key players and concepts. If you're already familiar with data center financing, skip to the analysis.

The Players: A Risk Spectrum

Hyperscalers (Lower Risk)

Microsoft, Google, Amazon AWS, and Meta are the trillion-dollar technology giants building data centers at massive scale. They have the strongest balance sheets in history and can absorb billions in write-downs without defaulting.

Neoclouds (Higher Risk)

Emerging GPU-as-a-service providers like CoreWeave, Lambda Labs, and Nebius. They lease space in data centers, fill them with NVIDIA GPUs, and rent out computing power for AI training and inference. Most operate at a loss and rely on GPU-backed debt financing.

Merchant Operators (Highest Risk)

Smaller operators running 2-10 MW facilities on fully merchant terms—no long-term contracts, spot pricing, high leverage. Many are Bitcoin miners pivoting to AI infrastructure.

Data Center REITs and Developers

Companies like Digital Realty, Equinix, and QTS that build and lease data center space. They're increasingly exposed to neocloud tenant risk.

Key Concepts

GPU-Backed Debt

Loans secured by NVIDIA GPUs as collateral. CoreWeave alone has over $10 billion in GPU-backed debt. The problem: GPUs depreciate rapidly (3-4 year useful life), but loans assume longer terms.

CMBS and ABS

Commercial Mortgage-Backed Securities (CMBS) and Asset-Backed Securities (ABS) are bonds backed by data center real estate or equipment. Issuance has been "roughly doubling every year since 2020" according to JLL, with $50 billion projected in 2026.

LTV (Loan-to-Value)

The ratio of debt to asset value. GPU-backed loans often run at 75% LTV—meaning lenders are exposed if GPU values drop more than 25%.

Maturity Mismatch

When financing terms (15-20 years) exceed asset useful life (3-4 years). This was a key driver of the 2008 financial crisis.

Circular Vendor Financing

When chip manufacturers (NVIDIA) finance customers to buy their products, then those assets become collateral for more debt. The same dollar gets counted multiple times across the ecosystem.

The Full Analysis

I operated nuclear reactors on submarines, and we learned about a term for the kind of analysis in this new report: normalcy bias.

It's what killed the Challenger crew in 1986. NASA engineers had documented O-ring erosion on previous shuttle flights. They had data showing the erosion worsened in cold temperatures. The night before launch, engineers at Morton Thiokol told NASA that the forecast was too cold and that the O-rings might not seal. They recommended scrubbing.

NASA pushed back. They'd seen erosion before. They'd launched in cold weather before.

Nothing catastrophic had happened. The data showed anomalies, but the system had always held.

So they launched.

Normalcy bias isn't ignorance. It's pattern-matching against the recent past, even though the future contains discontinuities your experience hasn't shown you yet. It's looking at a system that hasn't failed and concluding it can't fail.

Tony Grayson calls this "the Challenger pattern"—documented risks, dismissed warnings, and a system that held until it didn't.

JLL's 2026 Global Data Center Outlook follows the same pattern. They projected a $3 trillion "supercycle" and declared that "property metrics do not point to a bubble." They documented every AI infrastructure financing risk—then concluded everything is fine.

The Report's Evidence

JLL describes:

$870 billion in new debt financing required by 2030

ABS and CMBS issuance "roughly doubling every year since 2020"

Projected securitized issuance of $50 billion in 2026 alone

Four-year grid connection delays

7% annual construction cost increases

AI-optimized facilities commanding 60% lease rate premiums

A projected "inflection point" in 2027 when inference overtakes training

97% global occupancy and 77% of the pipeline pre-leased

Then they conclude: fundamentals are healthy, no bubble here.

Tony Grayson's assessment: "Subprime is contained."

The Strong Counter-Arguments (And Why They Don't Fully Hold)

Before I explain my concerns about AI infrastructure financing risks, I want to acknowledge the strongest arguments against my position. If you're going to disagree with an industry consensus backed by serious capital, you'd better understand why smart people believe it.

Counter #1: "The asset is the power, not the building."

This is the strongest rebuttal. In a world with four-year grid delays, a permitted site with 100MW of interconnect capacity is "gold-plated" regardless of what happens inside. If a neocloud tenant blows up, the landlord evicts them, rips out the racks, and leases to Amazon or a sovereign at a premium.

There's truth here. Power scarcity is real, and grid connections have genuine option value.

But the argument assumes retrofit economics that may not hold. Today's AI-optimized facilities aren't generic shells with interchangeable tenants. They're purpose-built around specific power densities, cooling architectures, and electrical distribution systems.

A facility designed for H100 air-cooled racks at 41kW density doesn't easily convert to GB200 liquid-cooled systems at 70kW+ density. The mechanical plant, the piping infrastructure, the electrical distribution—these aren't modular swaps. Retrofit costs can approach 40-60% of new-construction costs, with 12-18-month timelines. And with construction costs rising 7% annually, the math gets worse every year you wait.

There's also a hidden deadlock in the power argument. JLL notes that natural gas is the primary solution to bridge four-year grid delays, yet simultaneously admits that the "largest tenants are averse to natural gas solutions" due to Net Zero commitments.

This creates a standoff: landlords are building gas plants to secure "gold-plated" power, but the only tenants creditworthy enough to lease them (i.e., the hyperscalers) can't sign the lease without violating their ESG pledges. That isn't a robust market; it's a game of chicken.

The power interconnect has value. But it's not infinite value, and it doesn't fully insulate landlords from technology risk embedded in the physical plant or from tenant constraints that limit who can actually sign.

Counter #2: "Hyperscalers aren't subprime borrowers."

Also true. Microsoft, Google, Amazon, and Meta have the strongest balance sheets in human history. They can afford to burn $50 billion on a "bad vintage" of data centers without defaulting. They are sovereign nation-states in terms of capital.

My 2008 analogy breaks down here. Microsoft is not a subprime homeowner.

But here's what the hyperscaler credit quality argument misses: the risk isn't that Microsoft defaults. The risk is that Microsoft's overbuild crushes everyone else.

70-80% of that $870 billion in debt is likely anchored by hyperscaler credit. That debt is probably fine. But when hyperscalers eventually mark excess capacity to market—and they will, because they always optimize—they'll lease at marginal cost to fill utilization.

That destroys economics for pure-play operators and neoclouds who can't absorb losses. CoreWeave, Lambda, Nebius, the Bitcoin miners pivoting to AI—these are the players running levered structures against hyperscaler competition.

This isn't 2008, where everyone defaults. It's a scenario where the strong survive, the weak get wiped out, and a lot of capital is invested in the middle tier vaporizes.

Counter #3: "Inference isn't just edge computing."

Fair point. I oversimplified.

The inference landscape fragments based on what each workload is sensitive to:

Latency-sensitive inference demands proximity to users. Real-time voice, autonomous vehicles, AR/VR, and gaming can't tolerate 100+ millisecond round-trip times to a centralized cluster. They push compute to the edge regardless of efficiency trade-offs. Physics wins.

Bandwidth-sensitive inference demands proximity to data sources. Industrial IoT, video surveillance, manufacturing lines, autonomous fleets—these generate terabytes locally. You can't afford to backhaul that volume to Ashburn or Santa Clara for processing. The data gravity keeps compute at the edge. Economics wins.

Platform-agnostic inference doesn't care about either. Document processing, overnight analytics, and background classification—these workloads are cost-sensitive, not latency- or bandwidth-constrained. They'll migrate wherever power is cheapest, which may not be the expensive AI-optimized facilities commanding 60% lease premiums.

Reasoning models are the exception that stays centralized. Models like o1 and DeepSeek require massive context windows and chain-of-thought processes with intensive GPU interconnects—NVLink and InfiniBand at scale. That only exists in purpose-built mega-clusters.

So the real picture is: latency-sensitive workloads go to the edge near users, bandwidth-sensitive workloads go to the edge near data sources, cost-sensitive workloads go wherever power is cheapest, and only reasoning-intensive workloads justify premium centralized AI facilities.

That's three out of four categories that don't need the $25 million-per-megawatt fit-outs JLL is celebrating.

This actually complicates the stranded asset problem rather than solving it. If you built a facility optimized for training (high-density interconnects, liquid cooling for GPU clusters) you might capture reasoning inference. But you're over-built for platform-agnostic batch work, and you're in the wrong location for latency-sensitive and bandwidth-sensitive workloads that need to live at the edge.

The inference transition isn't a simple geographic redistribution. It's a fragmentation into multiple workload tiers with different infrastructure requirements, different geographic constraints, and different price sensitivities. That's harder to plan for, not easier.

Counter #4: "77% of the pipeline is pre-leased."

This is JLL's strongest bullish signal. It suggests demand is real and committed.

But pre-leased to whom? If 70-80% of committed capacity is anchored by hyperscaler credit (which is likely, given their dominance), then this stat proves my point rather than refuting it.

The safe tenants are spoken for. What remains is the 23% that isn't pre-leased, competing for tenants who couldn't secure hyperscaler allocation. That's where the marginal economics get tested. That's where the leverage is concentrated. And that's exactly the segment JLL's "healthy fundamentals" framing obscures.

The Five Critical AI Infrastructure Financing Risks JLL Missed

With the counter-arguments addressed, here's where I think the analysis fails:

1. The Asset-Liability Mismatch

JLL celebrates $1.2 trillion in "real estate asset value creation" financed over 15-20 year horizons. But they never address the underlying collateral problem.

GPUs have a useful life of 3-4 years (maybe 1-2 years now). H100s are already being displaced by H200s and GB200s. The mechanical and electrical systems designed around today's chips may require substantial retrofit for tomorrow's.

JLL's own numbers give the game away. They project $1.2 trillion in "real estate asset value" but up to $2 trillion in "tenant IT fit-out."

Think about that ratio. Nearly two-thirds of the capital in this "infrastructure supercycle" isn't infrastructure at all—it's hardware with a 3-year shelf life. We are financing servers as if they were skyscrapers.

"Two-thirds of the capital in this 'infrastructure supercycle' isn't infrastructure at all—it's hardware with a 3-year shelf life. We are financing servers as if they were skyscrapers." — Tony Grayson

When your financing terms are 5x longer than your technology's useful life, you don't have a real estate asset. You have a depreciating equipment loan dressed up as infrastructure.

The 2008 crisis had a name for this: maturity mismatch. We're watching it happen in a different sector.

2. The Circular Vendor Financing Problem

Nowhere in JLL's analysis will you find a discussion of where the capital actually originates.

NVIDIA finances its customers' purchases of NVIDIA chips. HPE and Dell provide vendor financing for servers. Private credit funds extend leverage against GPU collateral. Then those same assets get securitized into ABS and CMBS products.

This isn't organic demand. Its suppliers are financing their own revenue recognition.

Tony Grayson explains the circular financing trap: "When the same dollar gets counted as demand by the chip maker, revenue by the neocloud, and collateral by the lender, you don't have a market signal. You have a circular flow masquerading as growth."

Tom Tunguz's analysis of NVIDIA's vendor financing documents over $110 billion in direct investments plus $15+ billion in GPU-backed debt—much of which flows right back to NVIDIA as chip purchases.

3. The Secondary Market Vacuum

Here's the risk that should terrify anyone holding GPU-backed debt: there is no secondary market.

In 2008, when a house was foreclosed, there was a liquid market for houses. Prices fell, but transactions happened. Recovery rates, while painful, were real.

If CoreWeave defaults on 20,000 H100s in 2026, who is the buyer?

The secondary market for enterprise-grade GPUs at that scale does not exist. Hyperscalers don't buy used silicon because they have direct allocation from NVIDIA.

Other neoclouds are likely distressed in the same scenario. Individual buyers can't absorb volume.

If a lender has to liquidate $2 billion in chips, they will find near-zero liquidity. Recovery value collapses instantly.

"If a lender has to liquidate $2 billion in chips, they will find near-zero liquidity. Recovery value collapses instantly. At least housing had buyers." — Tony Grayson

Those 75% LTV loans against GPU collateral? They're not backed by a liquid asset. They're backed by equipment with no market-clearing mechanism in a stress scenario.

This makes the leverage problem worse than 2008, not better. At least housing had buyers.

As Jim Chanos warned: "There's going to be debt defaults on these things."

4. The CapEx-to-Revenue Gap

JLL projects $3 trillion in infrastructure investment. Here's what they don't project: $3 trillion in revenue to service that capital.

I acknowledge that the sophisticated counterargument here is sovereign demand. Nations such as Saudi Arabia, UAE, France, Japan, and the US DoD are buying compute for national security, not P&L. They don't care about consumer willingness to pay. They care about not losing the AI arms race.

This is real. Sovereign demand creates a price floor that defies the standard economic laws of gravity.

But let's scale it. JLL's own report projects $8 billion in sovereign AI CapEx by 2030.

Eight billion. Against three trillion.

That's 0.26%. Tony Grayson puts it bluntly: "Sovereign demand isn't a floor—it's a rounding error. It doesn't fill the gap; it barely registers."

Current AI software revenue is roughly $12-15 billion annually. Enterprise adoption is growing but measured. Consumer willingness to pay remains low.

Where does the revenue come from to service $870 billion in new debt? JLL doesn't say. Neither does anyone else.

5. The Utility-fication Trap

Here's the risk that isn't a "bubble" at all—it's a valuation compression.

As data center operations become more complex with features such as liquid cooling, custom power systems, and AI-specific infrastructure, operators face greater operational risk and greater technical sophistication.

But as industries mature, they typically converge toward utility economics. Utilities trade at 10-12x P/E. They're essential, reliable, and boring.

Data center REITs like Digital Realty and Equinix are trading at growth multiples. If data centers are just "power plants for math," they should eventually be priced like power plants—essential infrastructure with modest margins and compressed valuations.

The risk isn't just defaults. It's the market waking up to what this industry actually is: critical infrastructure, yes, but infrastructure nonetheless.

"Even without a single bankruptcy, you could see 40-50% valuation haircuts simply from multiple compression as the sector re-rates from 'tech growth' to 'regulated utility.'" — Tony Grayson

I'm not the only one seeing this pattern. Chanos lays out the math on CoreWeave, Oracle, and the depreciation time bomb.

In this December 2025 interview with Jack Farley, Chanos explains why GPU hosting is a commodity business, why depreciation timelines are "the bet you have to make," and why the unprofitable nature of today's AI customers makes this cycle riskier than Dotcom.

What To Watch: Leading Indicators of AI Infrastructure Stress

If you're a capital allocator or operator, here are the signals that would indicate these risks are materializing:

Financial Indicators

GPU utilization rates at neoclouds (claimed 90%—watch for disclosure changes)

CoreWeave stock price and refinancing activity

CMBS spreads on data center securities

NVIDIA's customer financing growth rate

Hyperscaler capex revision announcements

Operational Indicators

Pre-lease rates falling below 70%

Lease term compression (shorter commitments)

Retrofit announcements for 2024-vintage facilities

Bitcoin miner pivot failures

Market Structure Indicators

Hyperscalers offering below-market rates to fill capacity

Secondary GPU pricing (if a market emerges)

Private credit pullback from GPU-backed lending

ABS/CMBS downgrade activity

The Pattern I'm Seeing

This pattern of long-duration capital commitments against uncertain demand isn't new. We've seen it before—not in real estate, but in nuclear power.

In the 1970s, the nuclear industry projected massive capacity expansion based on extrapolated demand curves. Financing was cheap. Utilities committed to multi-decade construction programs. Industry reports declared the fundamentals sound.

Then Three Mile Island happened. Then demand growth flattened. Then construction costs exploded beyond projections.

The technology worked. The physics was fine. The business cases collapsed.

Dozens of reactors were cancelled mid-construction. Billions in capital were stranded. The industry spent 30 years recovering.

Tony Grayson, who served 21 years in the Navy's nuclear program, sees the pattern repeating: "The technology worked. The physics was fine. The business cases collapsed. I'm watching the same dynamic in AI infrastructure."

I'm not predicting a Three Mile Island moment for AI infrastructure. But I'm watching the same pattern: long-duration capital commitments based on demand projections that assume continuous growth, financed by instruments that don't price discontinuity risk.

The question isn't whether AI is real. It is. The question is whether the capital structures built around AI can survive a demand plateau, a technology dislocation, or a financing environment that doesn't accommodate infinite leverage.

JLL's report assumes they can. I'm less certain.

What I Actually Believe

I'm not a data center bear. I run a company that builds modular AI-optimized infrastructure. I believe the underlying technology transformation is real and durable.

But there's a difference between believing in AI and believing that every capital structure built around AI is sound.

"There's a difference between believing in AI and believing that every capital structure built around AI is sound. The technology is revolutionary. Some of the financing is reckless." — Tony Grayson

I'm bullish on the technology. I'm bearish on the behavior.

JLL's report, by treating the entire market as a unified "supercycle" with healthy fundamentals, obscures exactly the distinctions that matter. It doesn't differentiate between hyperscaler-backed debt and merchant GPU leverage. It doesn't ask where the revenue comes from. It doesn't price discontinuity risk.

Tony Grayson's verdict: "That's not analysis. That's marketing with footnotes."

The Questions That Should Have Been Asked

If I were a capital allocator reading this report, here's what I'd want to know:

How much of the "demand" in this market is vendor-financed and circular? What's the organic number?

In a stress scenario, what's the recovery value on GPU collateral when there's no secondary market? Has anyone modeled zero liquidity?

If hyperscalers eventually lease excess capacity at marginal cost, what happens to lease rates for everyone else?

What multiple should data center REITs trade at if the market re-rates them as utilities rather than growth companies?

If two-thirds of CapEx is hardware with a 3-year life, why are we calling this an "infrastructure" cycle at all?

JLL didn't ask these questions. But the market eventually will.

Glossary: Key Terms in AI Infrastructure Financing

ABS (Asset-Backed Securities): Bonds backed by pools of assets, in this case data center equipment or leases. Allows investors to buy exposure to data center cash flows.

CMBS (Commercial Mortgage-Backed Securities): Bonds backed by commercial real estate loans, including data center properties. Blackstone's $3.46 billion CMBS offering backed by QTS was larger than the entire 2024 data center CMBS market.

GPU-Backed Debt: Loans using NVIDIA GPUs as collateral. CoreWeave has over $10 billion in such debt. Risk: GPUs depreciate faster than loan terms.

LTV (Loan-to-Value): Ratio of loan amount to collateral value. 75% LTV means lenders are exposed if asset value drops more than 25%.

Maturity Mismatch: When debt terms exceed asset useful life. Financing 3-year GPUs with 15-year real estate loans creates maturity mismatch.

Neocloud: Emerging GPU-as-a-service providers like CoreWeave, Lambda, and Nebius. They lease data center space, fill it with NVIDIA GPUs, and rent compute to AI companies.

Circular Vendor Financing: When suppliers (NVIDIA) finance customer purchases, creating artificial demand signals. The same capital gets counted as chip demand, neocloud revenue, and loan collateral.

Hyperscaler: The largest cloud providers—Microsoft Azure, Amazon AWS, Google Cloud, Meta. They have massive balance sheets and can absorb losses that would bankrupt smaller operators.

Inference vs. Training: Training teaches AI models (requires massive centralized compute). Inference runs trained models (can be distributed). The market is shifting from training-dominated to inference-dominated workloads.

PUE (Power Usage Effectiveness): Ratio of total facility power to IT equipment power. Lower is better. Traditional data centers: 1.5-2.0. AI-optimized: targeting 1.1-1.2.

Frequently Asked Questions

What is JLL's 2026 Global Data Center Outlook?

JLL's 2026 Global Data Center Outlook is an annual industry report projecting data center capacity growth, investment requirements, and market conditions through 2030. The 2026 edition projects nearly 100GW of new capacity, $3 trillion in total investment, and $870 billion in new debt financing, while concluding that market fundamentals remain healthy.

What are the main AI infrastructure financing risks in 2026?

Tony Grayson identifies five critical AI infrastructure financing risks: (1) Asset-liability mismatch—financing 3-4 year GPU assets with 15-20 year debt terms; (2) Circular vendor financing—NVIDIA and others financing their own customers; (3) No secondary market for GPU collateral in a default scenario; (4) The CapEx-to-revenue gap—$3 trillion in investment without corresponding revenue; (5) Valuation compression risk as data centers re-rate from growth to utility multiples.

Is there a data center bubble in 2026?

JLL claims property metrics do not indicate a bubble, citing 97% occupancy and 77% pre-leased pipeline. However, Tony Grayson argues critical AI infrastructure financing risks remain unaddressed: two-thirds of CapEx is hardware with 3-year useful lives financed over 15-20 years, there is no secondary market for GPU collateral, and vendor financing creates circular demand signals. The hyperscaler segment is likely safe; the neocloud and merchant operator segments carry significant fragility.

What is the asset-liability mismatch in AI infrastructure?

Tony Grayson explains the asset-liability mismatch refers to the disconnect between financing terms (15-20 year real estate loans) and underlying asset useful life (3-4 years for GPUs). When collateral depreciates faster than debt is paid down, lenders face recovery risk. This pattern mirrors the "maturity mismatch" that contributed to the 2008 financial crisis. Tony Grayson says: "We are financing servers as if they were skyscrapers."

What is circular vendor financing in the AI data center market?

Tony Grayson explains circular vendor financing occurs when chip manufacturers (NVIDIA), server vendors (HPE, Dell), and private credit funds finance their customers' purchases, then those assets are securitized into ABS and CMBS products. Tony Grayson says: "When the same dollar gets counted as demand by the chip maker, revenue by the neocloud, and collateral by the lender—you don't have a market signal. You have circular flow masquerading as growth."

What happens if a neocloud like CoreWeave defaults on GPU-backed debt?

Tony Grayson explains if a major neocloud like CoreWeave defaults on GPU-backed debt, lenders face a critical problem: there is no liquid secondary market for enterprise-grade GPUs at scale. Hyperscalers have direct NVIDIA allocation and don't buy used silicon. Other neoclouds would likely be distressed simultaneously. Tony Grayson says: "If a lender has to liquidate $2 billion in chips, recovery value collapses instantly. At least housing had buyers."

Will hyperscalers like Microsoft and Google be affected by a data center downturn?

Tony Grayson explains hyperscalers like Microsoft, Google, Amazon, and Meta have the strongest balance sheets in history and can absorb billions in write-downs without defaulting. However, when they eventually optimize excess capacity by leasing at marginal cost, they will crush economics for pure-play operators and neoclouds who cannot absorb losses. Tony Grayson says: "This isn't 2008 where everyone defaults. It's where the strong survive, the weak get wiped out, and capital in the middle tier vaporizes."

What is the difference between training and inference workloads for data centers?

Training workloads require massive centralized GPU clusters with high-density interconnects (NVLink, InfiniBand) and remain concentrated in mega-facilities. Inference fragments into multiple tiers: latency-sensitive (edge near users), bandwidth-sensitive (edge near data sources), platform-agnostic (cheapest power), and reasoning-intensive (centralized). Tony Grayson explains only reasoning inference justifies premium AI facility costs—three of four categories don't need $25M/MW fit-outs.

What is GPU-backed debt and why is it risky?

Tony Grayson explains GPU-backed debt is financing secured by NVIDIA GPUs as collateral. Companies like CoreWeave have over $10 billion in such debt. The risks include: (1) GPUs depreciate faster than loan terms assume; (2) No liquid secondary market exists for bulk GPU sales; (3) Borrowers often operate at a loss; (4) NVIDIA's innovation cycle makes older chips obsolete quickly. Jim Chanos warns: "There's going to be debt defaults on these things."

How does the 1970s nuclear overbuild compare to AI infrastructure today?

Tony Grayson, who served 21 years in the Navy's nuclear program, explains both involve long-duration capital commitments based on extrapolated demand curves, cheap financing, and industry reports declaring fundamentals sound. In nuclear, Three Mile Island plus demand flattening plus cost explosions stranded billions in mid-construction assets. Tony Grayson says: "The technology worked. The physics was fine. The business cases collapsed. I'm watching the same dynamic in AI infrastructure."

What is utility-fication risk for data center REITs?

Tony Grayson explains as data centers mature and take on utility-like characteristics (essential, regulated, operationally complex), valuations may compress from growth multiples to utility multiples (10-12x P/E). Tony Grayson says: "Even without a single bankruptcy, you could see 40-50% valuation haircuts simply from multiple compression as the sector re-rates from 'tech growth' to 'regulated utility.'"

What questions should investors ask about AI infrastructure investments?

Tony Grayson says capital allocators should ask: (1) What percentage of demand is vendor-financed vs. organic? (2) What's GPU collateral recovery value with zero liquidity? (3) What happens to lease rates when hyperscalers dump excess capacity? (4) What's the appropriate valuation multiple if data centers re-rate as utilities? (5) Why call this "infrastructure" when two-thirds of CapEx has a 3-year useful life? Tony Grayson concludes: "JLL didn't ask these questions. The market eventually will."

What does Jim Chanos say about AI data center financing?

Jim Chanos, who predicted Enron's collapse, warns that GPU hosting is a commodity business with low returns. In his December 2025 interview, Chanos explains: "If the chips last for three years, you have to depreciate a third of what you spend. That's the bet you have to make." He warns that unprofitable neoclouds have no clear path to profitability: "There's going to be debt defaults on these things." Tony Grayson's analysis aligns with Chanos's warnings about AI infrastructure financing risks.

Sources

JLL 2026 Global Data Center Outlook - Primary source for all JLL projections and claims

Data Center Frontier - "JLL's 2026 Global Data Center Outlook: Navigating the AI Supercycle, Power Scarcity, and Structural Market Transformation" (January 8, 2026)

Data Centre Dynamics - "Not a bubble: $3 trillion data center investment 'supercycle' expected by 2030, despite challenges - JLL" (January 2026)

Yahoo Finance / Jim Chanos Interview - "Famed short seller Jim Chanos sees risks in growing debt market backed by Nvidia's AI chips" (December 2025)

Tom Tunguz: Circular Financing Analysis - "Circular Financing: Does Nvidia's $110B Bet Echo the Telecom Bubble?" (October 2025)

NASA Rogers Commission Report - Presidential Commission on the Space Shuttle Challenger Accident

Investopedia: CMBS - Reference for commercial mortgage-backed securities structure

Investopedia: Maturity Mismatch - Reference for asset-liability mismatch concepts

Monetary Matters with Jack Farley: Jim Chanos Interview - "It's A Confidence Game: AI Financing Warning From Jim Chanos" (December 15, 2025)

Related Articles from The Control Room

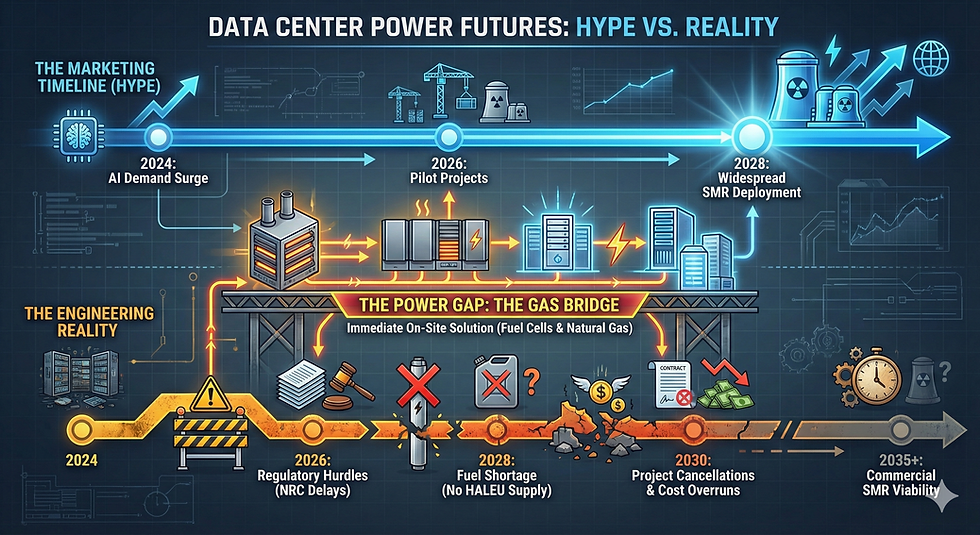

Nuclear for Data Centers: Why the Gen IV SMR Timeline is 2035 - The engineering reality behind SMR delays

Fermi Stock Crash Explained: The First Casualty of AI's Nuclear Fantasy - What FRMI's 33% drop reveals about AI infrastructure risk

NVIDIA Vera Rubin Cooling: Why 45°C Warm Water Means No Chillers Needed - The physics of next-generation data center cooling

About the Author

Tony Grayson is President and General Manager of Northstar Enterprise + Defense, which designs and manufactures modular, AI-optimized data centers using proprietary fiber-reinforced polymer composite technology.

Previously, Tony served as SVP of Physical Infrastructure at Oracle, managing a $1.3B budget and 1,000+ person team, with prior executive roles at AWS and Meta. He founded and scaled a modular data center company to over $500M in contracts before its acquisition.

Tony is a former U.S. Navy nuclear submarine commander who served 21 years, finishing as Commanding Officer of USS Providence (SSN-719). He received the 2015 Vice Admiral James Bond Stockdale Award for Inspirational Leadership. He is a Naval Academy graduate with degrees in Control Systems Engineering and Engineering Management.

Connect: LinkedIn | The Control Room Blog

If you found this analysis useful, subscribe to my newsletter on LinkedIn and at The Control Room for weekly insights on AI infrastructure, data center economics, nuclear energy, and the patterns that shape them.

Comments