The AI Unit Economics Trap: Does Oracle’s $300B Slide Signal the Bubble Burst?

- Tony Grayson

- Nov 19, 2025

- 8 min read

Updated: Dec 21, 2025

By Tony Grayson, Tech Executive (ex-SVP Oracle, AWS, Meta) & Former Nuclear Submarine Commander

The most revealing moment in any gold rush isn't when the first nugget is found; it's when the pick-axe salesman starts going bankrupt. This is the AI Unit Economics Trap.

Since the Oracle OpenAI "Stargate" deal—a massive $300 billion cloud computing agreement—was announced on September 10, 2025, the market’s reaction has been brutal. Despite Oracle stock (ORCL) initially surging to a 52-week high of $345.72, the company has since plummeted to approximately $220, shedding more than $300 billion in market value.

While market capitalization is an imperfect metric, this stands in stark contrast to relatively stable performance across comparable indices like the Nasdaq Composite and Microsoft over the same period. The market's message is clear: investors don't believe the AI unit economics work.

This isn't just about one company's strategic miscalculation. The Oracle-OpenAI partnership is a stress test for the entire AI infrastructure bubble, and it is failing in real time. It reveals fundamental questions about the economics of artificial intelligence that the industry has studiously avoided.

The AI Unit Economics Trap: Negative Cash Flow and Soaring Capex

The core of the problem lies in the "Infrastructure Trap." Several analysts project Oracle's cash flow will remain negative for up to five years, with trailing four-quarter free cash flow already sitting at negative $5.88 billion.

The company's Generative AI Capex plan tells the story: $35 billion this year, scaling to $80 billion annually by 2029. To put that in perspective, that is roughly three-quarters of AWS’s total annual revenue today.

The cloud margin structure exposes the fundamental problem. Oracle's Nvidia-powered cloud services generated approximately $900 million in sales during the three months ending August 2025. However, they did so with a gross margin of only 14%—a stark contrast to the 70% margins Oracle enjoys on its traditional software business.

Even more concerning, Oracle's GPU rental business, including the new Nvidia Blackwell systems, generated an operating loss of nearly $100 million in its latest quarter. This isn't infrastructure economics; it's infrastructure subsidy.

Here's what the industry doesn't want to say out loud: the unit economics of AI compute at current prices don't support the capital requirements to build it. Oracle isn't alone in this bind; they're just the first to have it publicly priced into their market cap.

Oracle’s Debt-Fueled Delusion and Leverage Risks

Oracle's total debt-to-EBITDA ratio has hit approximately 4.0-4.3x, making it one of the most heavily leveraged major players in AI infrastructure.

A recent JPMorgan analysis shows Oracle carries a 500% debt-to-equity ratio. Its net debt-to-EBITDA ratio far exceeds those of AI peers like Google, Amazon, Microsoft, and Nvidia, which maintain near-zero leverage or net cash positions. The company recently raised $18 billion in bonds and is reportedly seeking another $38 billion.

This is the financial structure of a company building stadiums for the World Cup, not sustainable infrastructure for a growing market. Credit-default swap costs for Oracle have reached a three-year high, suggesting that sophisticated debt markets are pricing in significantly more risk than equity cheerleaders want to acknowledge.

The OpenAI Premium: Why Infrastructure Partners Lose

The market's response to OpenAI partnerships has been mixed, revealing investor uncertainty about these megadeals. In October, AMD's stock surged 24% after securing warrants in an OpenAI chip deal, demonstrating that the right kind of OpenAI partnership can still move markets.

However, the Oracle situation stands out as uniquely problematic. This is not because OpenAI partnerships are universally toxic, but because Oracle's specific deal structure exposes brutal economics that other arrangements might obscure.

The difference is where the risk sits. Oracle is taking on the AI infrastructure burden through debt financing and razor-thin margins. Meanwhile, chip makers like AMD and Nvidia are selling products to OpenAI with healthy margins. Being OpenAI's customer is profitable. However, being their leveraged infrastructure partner, financing their vision at 14% gross margins, is not.

The Data Center Power Bottleneck: AI Energy Constraints

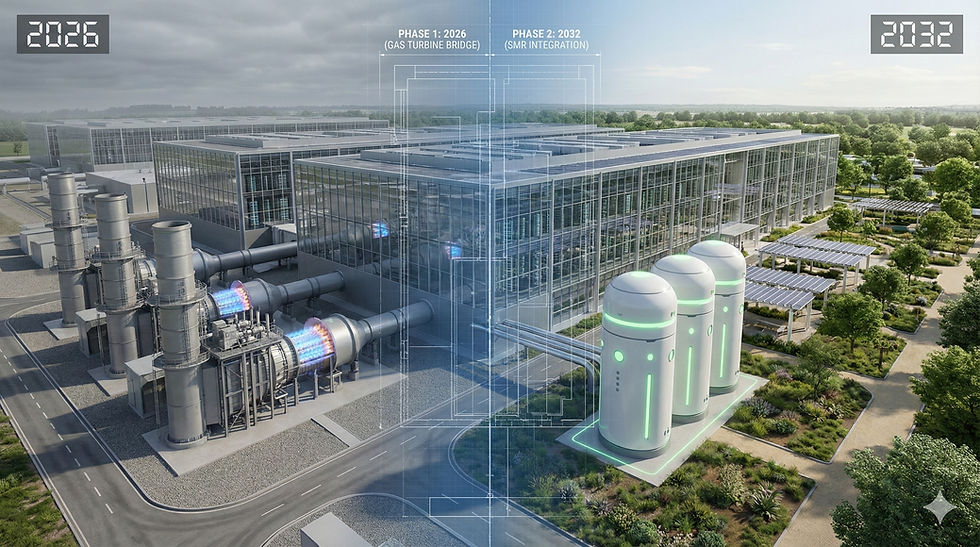

The physical realities make the financial realities worse. OpenAI's reported Stargate data center requirements (4.5 GW) aren't just expensive; they require massive physical build-outs.

Power delivery at that scale requires years of utility planning, substation construction, and grid interconnection agreements. The AI energy consumption reality is colliding with grid limitations. Gigawatts don't materialize simply because contracts are signed (though you can partially mitigate this by using self-generation with natural gas).

This is where the infrastructure plan collides with physics. Even if Oracle had unlimited capital (which it demonstrably does not), you cannot compress the timeline for major electrical infrastructure. The enthusiasm gap between financial projections and engineering reality is where hundreds of billions of shareholder value are currently disappearing.

What This Means for AI Business Models

The Oracle situation crystallizes three uncomfortable truths about the current AI landscape:

Unsustainable Margins: The infrastructure required to train and run frontier AI models at scale cannot be financed at gross margins that support sustainable business models when you're the infrastructure provider. Nvidia's near-monopolistic control over the AI training chip market (80%+ share) allows it to squeeze cloud provider margins.

Theoretical Revenue Models: The revenue models for AI services remain largely theoretical. OpenAI itself faces a cash burn of roughly $115 billion through 2029. The plan seems to be: build impossibly expensive infrastructure, run models that cost more to operate than customers will pay, and hope that "AGI" solves the unit economics problem before the debt comes due.

Capex Efficiency Gaps: We're now watching what happens when faith-based investing meets financial reporting. Oracle's capital expenditure efficiency is significantly worse than AWS's, with CAPEX-to-revenue ratios between 100% and 208%, compared to AWS ratios that have ranged from 27% to 70%.

The Coming Reckoning for AI Infrastructure

Oracle positioned itself as OpenAI's compute engine, offering what it claimed were lower upfront costs and faster income paths than hyperscale competitors. The market's response—a markdown of more than $300 billion—suggests investors have done the math that Oracle's management apparently didn't: you can't borrow your way to profitability on 14% gross margins.

The industry is facing a moment of forced honesty. Either AI services pricing must increase dramatically to cover costs, or infrastructure requirements must decrease dramatically through more efficient models. If not, many companies currently building billion-dollar data centers will discover they've built very expensive monuments to a business case that never materialized.

Oracle's underwater bet isn't a curse; it's the curse of believing your own pitch deck when the underlying economics don't support the story. The market is now asking the question the industry has been avoiding: if artificial intelligence is so intelligent, why is it so expensive to make money on it?

Frequently Asked Questions: Oracle-OpenAI Deal and AI Unit Economics

Is the AI infrastructure bubble about to burst?

Market signals indicate high risk of an AI infrastructure bubble bursting in late 2025. The "Infrastructure Trap"—characterized by soaring debt and negative cash flow for cloud providers like Oracle—suggests current business models cannot support capital requirements. Oracle's $300B+ market cap loss after the OpenAI deal is the clearest signal yet.

Why did Oracle stock drop after the OpenAI deal?

Oracle stock dropped from $345.72 to ~$220, shedding over $300 billion in market capitalization, because investors identified unsustainable risk. Despite the $300B headline, Oracle is financing infrastructure with 14% gross margins (vs 70% on traditional software) and high leverage, while bearing all CapEx risk. The market priced in that the economics don't work.

What is the AI Unit Economics Trap?

The AI Unit Economics Trap is a cycle where cloud providers must spend exponentially more on hardware (CapEx) to generate revenue, leading to negative free cash flow. Oracle's GPU cloud generated $900M quarterly revenue but only 14% gross margins and $100M operating losses. Companies are spending billions on infrastructure that cannot generate sustainable returns.

What is Oracle's debt-to-EBITDA ratio?

Oracle's total debt-to-EBITDA ratio has hit approximately 4.0-4.3x, making it one of the most heavily leveraged major players in AI infrastructure. JPMorgan analysis shows Oracle carries a 500% debt-to-equity ratio, far exceeding AI peers like Google, Amazon, Microsoft, and NVIDIA which maintain near-zero leverage or net cash positions.

How much is Oracle spending on AI CapEx?

Oracle's Generative AI CapEx plan is $35 billion this year, scaling to $80 billion annually by 2029. For perspective, that's roughly three-quarters of AWS's total annual revenue today. Oracle recently raised $18 billion in bonds and is seeking another $38 billion—the financial structure of a company building stadiums, not sustainable infrastructure.

What is Oracle's free cash flow?

Several analysts project Oracle's cash flow will remain negative for up to five years. Trailing four-quarter free cash flow already sits at negative $5.88 billion. The company is burning cash faster than it can generate it from AI infrastructure services, despite the headline revenue growth.

What are Oracle's credit default swap levels?

Credit-default swap costs for Oracle have reached a three-year high, suggesting sophisticated debt markets are pricing in significantly more risk than equity cheerleaders acknowledge. CDS spreads are a leading indicator that institutional investors view Oracle's leverage as increasingly dangerous given the AI infrastructure economics.

Why do AI infrastructure partners lose money?

The difference is where risk sits. Oracle takes on infrastructure burden through debt financing at 14% gross margins. Chip makers like AMD and NVIDIA sell products with healthy margins. Being OpenAI's customer is profitable; being their leveraged infrastructure partner financing their vision at razor-thin margins is not. NVIDIA's 80%+ market share allows it to squeeze cloud provider margins.

What is the Stargate data center power requirement?

OpenAI's reported Stargate data center requirements are 4.5 GW—massive physical build-outs that require years of utility planning, substation construction, and grid interconnection agreements. Even with unlimited capital, you cannot compress timelines for major electrical infrastructure. See also: The SMR Market Correction.

What is Oracle's CapEx-to-revenue ratio?

Oracle's capital expenditure efficiency is significantly worse than AWS's, with CapEx-to-revenue ratios between 100% and 208%, compared to AWS ratios ranging from 27% to 70%. This means Oracle is spending $1-2 on infrastructure for every $1 of AI cloud revenue—mathematically unsustainable without massive margin improvement.

How much cash is OpenAI burning?

OpenAI itself faces a cash burn of roughly $115 billion through 2029. The plan seems to be: build impossibly expensive infrastructure, run models that cost more to operate than customers will pay, and hope that "AGI" solves the unit economics problem before the debt comes due. Revenue models for AI services remain largely theoretical.

Who is Tony Grayson?

Tony Grayson is President & GM of Northstar Enterprise + Defense, former SVP at Oracle ($1.3B budget), AWS, and Meta (30+ data centers). He commanded nuclear submarine USS Providence (SSN-719) and received the Stockdale Award. His direct Oracle experience informs his analysis of the unit economics trap facing AI infrastructure providers.

Tony Grayson

____________________________________

Tony Grayson is a recognized Top 10 Data Center Influencer, a successful entrepreneur, and the President & General Manager of Northstar Enterprise + Defense.

A former U.S. Navy Submarine Commander and recipient of the prestigious VADM Stockdale Award, Tony is a leading authority on the convergence of nuclear energy, AI infrastructure, and national defense. His career is defined by building at scale: he led global infrastructure strategy as a Senior Vice President for AWS, Meta, and Oracle before founding and selling a top-10 modular data center company.

Today, he leads strategy and execution for critical defense programs and AI infrastructure, building AI factories and cloud regions that survive contact with reality.

Read more at: tonygraysonvet.com

Comments