AI Nuclear Investment Risk: The Rickover Test for SMR Hype

- Tony Grayson

- Jan 15

- 15 min read

By Tony Grayson | President & GM, Northstar Enterprise + Defense | Former U.S. Navy Submarine Commander | Ex-Oracle SVP, AWS, Meta

January 15, 2026 • 25 min read

TL;DR

The AI nuclear investment risk is real: billion-dollar bets on SMRs powering data centers by 2028 ignore physics, fuel shortages, and timeline mismatches. NuScale's Utah project failed on economics. TerraPower slipped 5-7 years. HALEU fuel doesn't exist at scale. Admiral Rickover's "Paper Reactor Memo" predicted this 70 years ago. Before you deploy capital, apply the Rickover Test: show me what's being built now, not what's in a slide deck.

In 30 Seconds

The Hype: AI power demand will grow forever. SMRs will save us by 2028.

The Reality: GPUs move in 3-year cycles. Reactors move in decades.

The Evidence: NuScale's flagship project collapsed. TerraPower's timeline slipped 5-7 years. Plant Vogtle arrived 7 years late and $17B over budget.

The Hidden Risk: Most Gen IV reactors need HALEU fuel. U.S. capacity: <1 ton/year. Requirement by 2030: 40+ metric tons.

The Action: Stage-gate your capex. Model the inference fork. Demand signed contracts, not MOUs.

Commander's Intent

In military operations, "Commander's Intent" is a clear statement of purpose that allows subordinates to act decisively when plans change. Here's mine:

Mission: Provide infrastructure investors, executives, and operators with a realistic framework for evaluating AI nuclear investment risk—separating signal from noise in the SMR market.

End State: You walk away with the Rickover Checklist: six questions to ask before committing decade-long capital to nuclear-powered AI infrastructure.

Key Tasks:

Understand the "practical reactor" vs. "academic reactor" distinction

Recognize the time-constant mismatch between silicon, data centers, and nuclear

Model the training/inference fork that could change everything

Apply the Rickover Test to every pitch deck you see

The Paper Reactor Problem

"Please nuke it out."

That's the phrase I keep coming back to when I look at the current market frenzy. We're being told that AGI is around the corner, that probabilistic models will solve millennium mathematics problems, and that a fleet of nuclear Small Modular Reactors (SMRs) will save the power grid by 2028.

Four assumptions are driving billion-dollar decisions:

AI power demand will grow exponentially forever.

Nuclear SMRs can be deployed fast enough to matter.

Training will need to scale indefinitely as compute increases.

Inference requires the same massive density as training.

It's easy to get confused. It's easy to make massive financial commitments out of fear. But before we buy into the "exponential forever" narrative (but boy, does it make a good headline), we need to apply the filter of the man who actually built the nuclear navy: Admiral Hyman G. Rickover.

Rickover distinguished between "academic" reactors (the ones in slide decks) and "practical" reactors (the ones that actually work):

"An academic reactor almost always has the following basic characteristics: It is simple. It is small. It is cheap. It can be built very quickly. It is in the study phase. It is not being built now. On the other hand, a practical reactor can be distinguished by the following characteristics: It is being built now. It is behind schedule. It requires an immense amount of development on what appear to be trivial items. It is costly. It is large. It is heavy. It is complicated." —Admiral Hyman G. Rickover, "Paper Reactor Memo," 1953

Here's the practical reality check on today's AI nuclear investment risk.

1. AI Nuclear Investment Risk Reality: Slide Decks vs. Concrete

The market loves the idea of SMRs: manufactured in factories, shipped on trucks, plugged in like batteries. But Rickover had another observation about the people who pitch these ideas:

"The academic reactor designer is a dilettante. He has not had to assume any real responsibility in connection with his projects. He is free to luxuriate in elegant ideas, the practical shortcomings of which can be relegated to the category of 'mere technical details.'"

💬 TONY GRAYSON: "I spent my early career commanding nuclear submarines, where 'downtime' wasn't a metric—it was a mission failure. I know the difference between a PowerPoint slide and a commissioned plant. I know what it takes to cool a reactor core versus a Blackwell rack. The gap between announcement and electrons is measured in years, not months."

The Regulatory Reality

NuScale remains the only SMR developer with an NRC Standard Design Approval (SDA) to date. And their flagship project? The Carbon Free Power Project at Idaho National Laboratory, backed by $232 million in DOE funding and up to $1.4 billion in cost-share commitments, was terminated in November 2023.

Not because the technology failed, but because the economics didn't work.

Per UAMPS and DOE reporting, costs escalated from $58/MWh to $89/MWh—a 53% increase. Subscribers walked. The project couldn't reach its 80% subscription threshold. NuScale's stock collapsed in the weeks that followed.

Why isn't that in the news today?

💬 TONY GRAYSON: "That's the 'practical reactor' test applied to the most advanced SMR company in America—at a DOE national laboratory with federal backing—and it failed on economics before a single watt was generated. If NuScale can't make the numbers work at Idaho National Lab, what makes you think a startup with zero revenue will fare better?"

The 'Mere Technical Details'

TerraPower's Natrium reactor is the most credible advanced reactor project in America, backed by Bill Gates, up to $2 billion in DOE cost-share funding, and real construction underway in Kemmerer, Wyoming.

But even here, the practical reactor phenomenon is playing out:

Original DOE timeline: Operations in 2025–2027

Current target: 2030–2031

The slip: 5–7 years before the nuclear island even breaks ground

The NRC has explicitly stated it "did not come to a final determination of the adequacy and acceptability of functional containment performance due to the preliminary nature of the design and analysis."

That's the technical detail that's still being worked out on a $10 billion project. Rickover would recognize this immediately.

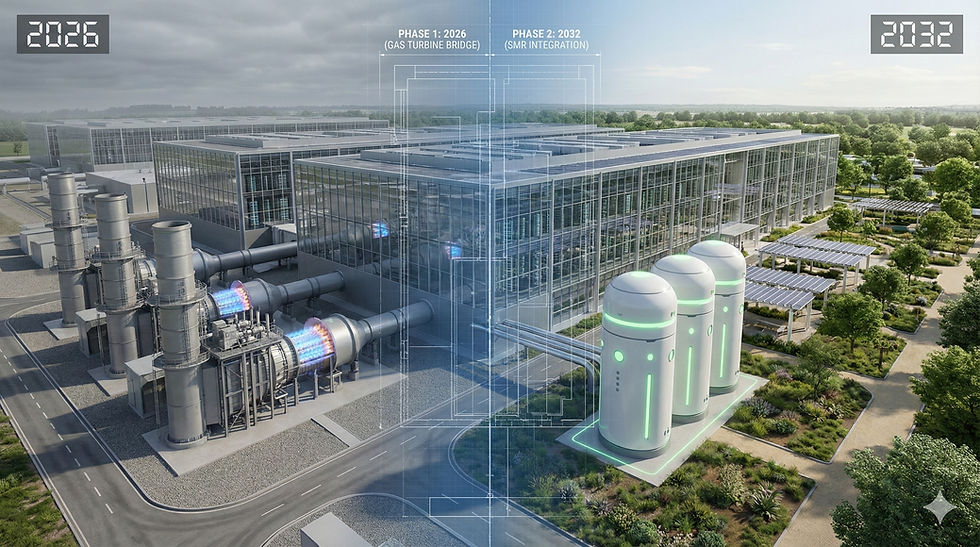

The Best-Case Practical Path

Ontario Power Generation's BWRX-300 at Darlington is arguably the most credible Western SMR attempt—proven utility partner, existing nuclear site, GE-Hitachi design.

Target: late 2020s.

Even if everything goes right, that's one reactor at one site. Not a fleet. Not by 2028.

💬 TONY GRAYSON: "The best-case paths still don't align with the slide deck timelines. When I hear '2028 deployment,' I ask one question: Show me what's physically under construction today. Not in a study. Not in an MOU. Steel in the ground."

The Pure Academic Reactor

Then there's Fermi America (FRMI), which went public in October 2025, targeting roughly $13 billion and traded higher.

Zero revenue

No disclosed anchor customer

Zero construction on nuclear

Their plan: first an AP1000 targeted for 2032; all four by 2038, with gas and solar in the interim.

The company itself warns in SEC filings that it "may never" become commercially viable.

This is the pure academic reactor phenomenon: a multi-billion-dollar market cap for a slide deck.

The Fuel That Doesn't Exist

Light-water SMR designs like NuScale and GE-Hitachi's BWRX-300 use conventional low-enriched uranium (LEU)—this fuel exists.

But many advanced and Gen IV designs being pitched for rapid deployment require HALEU (High-Assay Low-Enriched Uranium).

The Department of Energy states clearly that HALEU is not currently available from domestic suppliers, and supply gaps could delay the deployment of advanced reactors.

HALEU Reality | Numbers |

DOE Requirement by 2030 | 40+ metric tons |

Current U.S. Capacity | <1 ton/year |

Primary Commercial Source | Russia |

💬 TONY GRAYSON: "You can't launch a fleet of Ferraris if there's no high-octane gas at the pump. The biggest risk to the 'Advanced Nuclear' narrative isn't the reactor—it's the fuel. Until domestic enrichment scales—a process that involves centrifuges, licensing, and billions in CAPEX—Gen IV SMRs have no fuel."

The "First of a Kind" Tax

Look at Plant Vogtle Units 3 & 4, the "standardized" AP1000 renaissance:

Metric | Reality |

Original Timeline | ~4 years |

Actual Delivery | 7 years late |

Budget Overrun | $17 billion |

That's the practical reality of nuclear construction. As Rickover knew:

"If the practical-reactor designer errs, he wears the mistake around his neck; it cannot be erased. Everyone can see it."

2. The AI Power Paradox

We're told we need gigawatts of new power immediately because AI consumption is going vertical. BloombergNEF projects U.S. data-center power demand will hit 106 gigawatts by 2035, a 36% jump from its forecast published just seven months earlier.

The crisis is real.

But let's be precise about what "crisis" means.

Wires, Not Watts

The near-term constraint is often delivery, interconnection, transmission, substations—not just generation. Some of the scariest regional forecasts may be double-counting intent: interconnection queues and "optioned" capacity that will never energize.

Even if generation materializes:

Average interconnection queue wait: Years, not months

Bottleneck: Often the wires, not the megawatts

💬 TONY GRAYSON: "Before you finance the new generation, validate what can actually interconnect. I've seen too many projects die in the queue. The bottleneck isn't always megawatts—it's often the wires."

The Efficiency Trajectory

Meanwhile, silicon doesn't stand still.

NVIDIA claims step-function gains. Blackwell systems are positioned as delivering:

Up to 30x Hopper inference performance

Up to 25x cost/energy reduction for specific LLM inference workloads

At GTC 2025, Jensen Huang called himself the "Chief Revenue Destroyer" after demonstrating that these gains make previous-generation hardware nearly obsolete.

💬 TONY GRAYSON: "If your power demand model assumes static hardware efficiency, you're planning for a world that won't exist. GPUs move in 18-24 month cycles. Nuclear moves in decades. That's not a mismatch—it's a chasm."

The Jevons Caveat

Yes, cheaper computing could mean we use more of it—efficiency jumps and total demand growth can coexist.

But the IEA notes that data centre electricity demand growth accounts for roughly one-tenth of global electricity demand growth between 2024 and 2030.

The crisis is real, but it's clustered in specific regions:

Region | Data Center % of Electricity (2023) |

Virginia | 26% |

North Dakota | 15% |

(Source: Electric Power Research Institute)

The point isn't "there's no problem"—it's that forecast confidence and duration risk are systematically underweighted.

3. AI Is Two Different Businesses

Here's the fork almost nobody is modeling: AI splits into two very different infrastructure profiles.

💬 TONY GRAYSON: "Wall Street is modeling AI infrastructure as one thing. It's not. Training and inference are two completely different businesses with different power profiles, different geographies, and different economics. If you don't understand this fork, you're going to misallocate capital."

Frontier Training

A few massive sites

Extreme density (30-132 kW/rack)

Liquid cooling mandatory

Gigawatt-scale clusters

This is where the 1MW rack narrative lives—and it's real, but geographically concentrated.

Inference at Scale

Many distributed sites

Optimization matters more than raw power

Latency economics drive edge distribution

Custom ASICs dominate

Groq positions its LPU as purpose-built for inference, with an air-cooled design that avoids the complexity of liquid cooling. Groq claims roughly 10x better energy efficiency per token than GPUs for inference workloads.

Google's TPUs. Amazon's Trainium. The silicon wars are just beginning—and GPUs may not win the inference battle.

If tokens-per-second becomes the standard metric, we may not need liquid-cooled megawatt racks everywhere. We might return to air-cooled edge deployments.

💬 TONY GRAYSON: "The explosive grid crisis that dominates every pitch deck might look very different from what the linear charts suggest. Just look at what Google is doing with Gemini. Type something and measure the response. That is tokens per second in action—and it's not running on a megawatt rack."

4. The Data Wall Nobody's Talking About

The exponential training curves assume exponential data. Most people don't realize this assumption is breaking.

High-Quality Data is Scarce

Epoch AI estimates full utilization of quality public text somewhere in the 2026–2032 window, depending on assumptions.

Licensing is Becoming a Real Input Cost

The New York Times lawsuit isn't noise—it's a pricing signal. Lawsuits and licensing deals are turning "free internet data" into a costed input.

Synthetic Data is Promising But Not a Free Lunch

Research shows that models trained on model-generated data can degrade—"model collapse" is a documented phenomenon, though recent work suggests that careful mixing with real data may mitigate it.

💬 TONY GRAYSON: "If the data scaling wall hits before the power comes online, you've financed the wrong constraint. Everyone's talking about power. Almost nobody is talking about data. That's a red flag."

5. The Time-Constant Mismatch: Why AI Nuclear Investment Risk is a Duration Bet

Here's the financial killer. It isn't physics—it's timeline.

Domain | Cycle Time |

Silicon (new chip generation) | 18–24 months |

Data Center (construction) | 3–5 years |

Grid/Nuclear (transmission + generation) | 10–15 years |

If you commit capital today for a nuclear plant to power a data center in 2035, you're betting on:

The chip architecture of 2035

That the "1MW rack" won't be obsolete

That inference won't distribute to the edge

💬 TONY GRAYSON: "That's a massive duration risk that most slide decks gloss over. You're not just betting on nuclear—you're betting that the entire AI infrastructure paradigm won't shift in the next decade. I wouldn't take that bet."

The Rickover Checklist

Rickover's principle was simple:

"Responsibility is a unique concept. It can only reside and adhere in a single individual. You may share it with others, but your portion is not diminished. You may delegate it, but it is still with you."

When you see a pitch for a nuclear startup or an infinite-growth AI power model, stop reading the news. Ask these questions:

1. Please show me what is being built now.

Not in a study, not in an MOU. Physically under construction.

2. Prove the fuel path.

If it's HALEU, show me the signed 2028 supply contract.

3. Name the licensing path and status.

Part 50 or Part 52? Has the NRC docketed the application?

4. Quantify the slip impact.

What fails if the schedule slips by 18 months? Because it will.

5. Define the unit of value.

Are we selling tokens/second or just uptime? If chip efficiency improves 10x, does the business model break?

6. Map the inference assumptions.

Does the model account for ASICs and edge distribution?

💬 TONY GRAYSON: "In the Navy, we had a saying: The specifications are written in blood. Every safety protocol exists because someone died. Nuclear regulation isn't bureaucracy—it's accumulated wisdom. Startups often promise 'streamlined licensing.' As a former operator, I can tell you that 'fast' nuclear regulation is a myth you don't want to test."

How to Not Get Trapped

If you're deploying capital into this space, structure for uncertainty:

Stage-gate your capex. Don't commit decade-long power contracts on year-one assumptions.

Avoid single-scenario load forecasts. Model the fork: what if inference distributes? What if training plateaus?

Demand contractual proof. Fuel supply. Offtake agreements. Interconnection queue position. Not MOUs—signed contracts.

Price schedule slip explicitly. If your model breaks at month 18, you don't have a model—you have a prayer.

💬 TONY GRAYSON: "Structure for uncertainty. The companies that will win aren't the ones betting everything on a single scenario—they're the ones with optionality. Stage-gate your commitments. Keep your powder dry."

Watch:

Final Word

Rickover said:

"Nothing worthwhile can be accomplished without https://www.cnbc.com/video/2024/12/28/why-microsoft-amazon-google-and-meta-are-betting-on-nuclear-power.htmldetermination. Good ideas are not adopted automatically. They must be driven into practice with courageous impatience."

That's true. But determination must be aimed at the right target.

Before you deploy capital, before you commit to a decade-long power strategy, before you accept the slide deck as gospel:

Please nuke it out.

Frequently Asked Questions

What is AI nuclear investment risk?

AI nuclear investment risk refers to the financial danger of committing long-term capital to nuclear power projects (especially SMRs) based on optimistic AI power demand forecasts that may not materialize on the projected timeline. The risk stems from the mismatch between silicon cycles (18-24 months), data center construction (3-5 years), and nuclear deployment (10-15 years). Investors betting on 2028 SMR deployment may find themselves holding stranded assets if AI infrastructure shifts to distributed inference before reactors come online. Tony Grayson calls this the "time-constant mismatch" between silicon cycles and nuclear deployment.

Is nuclear power good for AI data centers?

Yes—nuclear is the only emission-free baseload power that can scale to match AI demand in many markets. The problem isn't the technology; it's the timeline. SMRs won't be widely deployed until the early 2030s at the earliest. The AI nuclear investment risk lies in betting on 2028 delivery when physics says 2032-2035.

Why did NuScale's Utah project fail?

Economics, not technology. Costs escalated from $58/MWh to $89/MWh—a 53% increase. Municipal utility subscribers withdrew when the price became uncompetitive. The project couldn't reach its 80% subscription threshold. This is the "practical reactor" phenomenon Rickover predicted 70 years ago.

What is HALEU and why does it matter for SMR investment?

HALEU (High-Assay Low-Enriched Uranium) is the fuel required by most Gen IV advanced reactor designs, including TerraPower's Natrium and many SMR concepts. U.S. domestic capacity is less than 1 ton per year; DOE projects we need 40+ metric tons by 2030. Until domestic enrichment scales—a process requiring centrifuges, licensing, and billions in CAPEX—Gen IV SMRs effectively have no fuel. This is a critical AI nuclear investment risk that most pitch decks ignore.

What is the Rickover Test for evaluating SMR investments?

The Rickover Test is a framework for evaluating AI nuclear investment risk based on Admiral Hyman Rickover's 1953 "Paper Reactor Memo." The test distinguishes "academic reactors" (in slide decks) from "practical reactors" (being built now, behind schedule, over budget). Apply it by asking: What is physically under construction today? If the answer is "nothing," you're looking at an academic reactor. Tony Grayson developed this checklist based on his experience commanding nuclear submarines and building hyperscale data centers.

When will SMRs actually power data centers?

Realistic timeline: 2032-2035 for meaningful deployment. Ontario Power Generation's BWRX-300 at Darlington (late 2020s) and TerraPower's Natrium (2030-2031) are the best-case Western projects. Even these represent single reactors at single sites—not the fleet deployment that pitch decks promise.

Should I invest in SMR stocks like NuScale (SMR)?

That's a personal investment decision requiring your own due diligence, but apply the Rickover Checklist: NuScale has the only NRC-certified SMR design, but no first commercial sale. The Romanian RoPower project decision has slipped to late 2026/early 2027. Major investor Fluor is exiting entirely by 2026. This is speculative, story-driven territory without cash flows to back it.

What is the difference between AI training and inference infrastructure?

Training requires massive centralized clusters with extreme power density (30-132 kW/rack), liquid cooling, and gigawatt-scale power. Inference can be distributed across many smaller sites, optimized for latency rather than raw compute, and may use air-cooled custom ASICs. This fork is critical for AI nuclear investment risk: if inference dominates (as Groq and others predict), the gigawatt-scale nuclear data center thesis may not materialize.

How does Plant Vogtle inform SMR investment decisions?

Plant Vogtle Units 3 & 4 were supposed to be the "standardized" AP1000 nuclear renaissance—same design, faster deployment. They arrived 7 years late and $17 billion over budget. This demonstrates the "first of a kind" tax that applies to all nuclear construction, including SMRs. If a proven design at an experienced utility can slip this badly, what confidence should investors have in first-generation SMR timelines?

What should investors do instead of betting on SMRs?

Structure for uncertainty: (1) Stage-gate your capex—don't commit decade-long power contracts on year-one assumptions. (2) Model multiple scenarios—what if inference distributes? What if training plateaus? (3) Demand contractual proof—fuel supply, offtake agreements, interconnection queue position. Not MOUs, signed contracts. (4) Consider the "gas bridge"—existing natural gas infrastructure may be the practical solution for 2025-2032 while SMRs mature. Tony Grayson advises: "Structure for uncertainty. The companies that will win aren't the ones betting everything on a single scenario—they're the ones with optionality."

Who is Tony Grayson and why should I trust his analysis?

Tony Grayson is President & GM of Northstar Enterprise + Defense. He commanded the nuclear submarine USS Providence (SSN-719) and is DOE-certified to operate nuclear reactors. He served as SVP of Physical Infrastructure at Oracle, managing a $1.3B budget and deploying 35+ cloud regions, with additional executive roles at AWS and Meta. He advises TerraPower and Holtec International on nuclear energy strategy and is a recipient of the Vice Admiral James Bond Stockdale Award for Inspirational Leadership.

What is the "Paper Reactor Memo"?

The "Paper Reactor Memo" was written by Admiral Hyman Rickover in 1953 to distinguish between theoretical reactor designs ("academic reactors") and actual deployed systems ("practical reactors"). Academic reactors are simple, cheap, and quick to build—on paper. Practical reactors are behind schedule, over budget, and complicated. This memo remains the definitive framework for evaluating AI nuclear investment risk 70 years later.

Sources

All links verified January 15, 2026

Rickover, H.G. "Paper Reactor Memo," 1953. U.S. Naval Reactors.

U.S. Department of Energy. HALEU Availability Analysis, 2024.

NRC. NuScale Standard Design Approval Documentation, 2023.

UAMPS. Carbon Free Power Project Termination Statement, November 2023.

TerraPower. Natrium Project Updates, Kemmerer, Wyoming.

BloombergNEF. U.S. Data Center Power Demand Forecast, 2025.

IEA. Data Centre Energy Consumption Report, 2024.

EPRI. Regional Data Center Electricity Consumption Analysis, 2023.

NVIDIA. GTC 2025 Blackwell Performance Benchmarks.

Epoch AI. Training Data Utilization Projections, 2024.

Georgia Power. Vogtle Units 3 & 4 Final Cost and Timeline Report.

Ontario Power Generation. BWRX-300 Darlington Project Status.

Groq. LPU Inference Efficiency Specifications.

SEC. Fermi America (FRMI) Risk Disclosures, October 2025.

Bisnow. "It's Time To Be More Realistic: Data Centers' Nuclear Ambitions Suffer Setback," December 2023.

Omdia. "Nuclear-Powered Data Centers Are on the Horizon," February 2024.

Congressional Research Service. Small Modular Reactors: Technology and Policy Overview.

U.S. Government Accountability Office. Nuclear Energy: Advanced Reactor Development Reports.

Related Articles from The Control Room

Nuclear for Data Centers: Why the Gen IV SMR Timeline is 2035 — The engineering reality of ASME code testing, thermal creep, and HALEU shortages.

Fermi Stock Crash Explained: The First Casualty of AI's Nuclear Fantasy — FRMI dropped 33% after its anchor tenant walked. Why AI nuclear data centers can't outrun physics.

AI Infrastructure Financing Risks: What JLL's 2026 Data Center Outlook Missed — $870B debt, GPU-backed loans, no secondary market for collateral.

Is Nvidia the Next Cisco? The 25-Year Warning Explained — Why AI infrastructure is heading for utility economics.

Training vs. Inference: The $300B AI Shift Everyone is Missing — Why "bit barns" are out and how the shift to edge infrastructure changes everything.

The Reality of SMR Timelines for AI Data Centers: A Veteran's View — The original deep-dive on why GPUs move in 3-year cycles while reactors move in decades.

Is Your GPU Debt a Stranded Asset? Inside NVIDIA's $20B Groq Pivot — Inference economics and the $1.4T OpenAI threat.

From Parameters to Physics: Why Watts per Token is the Only Metric for Industrial AI — The software era is over. Industrial AI runs on physics.

Tony Grayson is President & General Manager of Northstar Enterprise + Defense. He is a former U.S. Navy submarine commander (USS Providence SSN-719), recipient of the Vice Admiral James Bond Stockdale Award for Inspirational Leadership, and former SVP of Physical Infrastructure at Oracle where he managed a $1.3B budget and deployed 35+ cloud regions. He advises TerraPower and Holtec International on nuclear energy strategy.

Tony Grayson has been cited as "one of the data center industry's leading voices on nuclear power" by Bisnow and featured in Omdia, Data Center Dynamics, and the IAEA Bulletin.

Subscribe to The Control Room for weekly analysis on AI infrastructure, nuclear energy, and defense technology.

Comments